Dollar Index Value and Some Rates in Different Countries

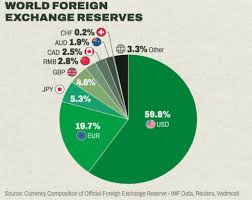

The dollar index climbed beyond 106.6 points on Thursday because President Donald Trump’s most recent tariff announcements made market participants vigilant. Wednesday brought news from Trump regarding 25% tariffs on European products alongside delayed plans to initiate Mexico-Canada tariffs on April 2 rather than March 4.

Market participants have absorbed Donald Trump’s inconsistent signals but different traders doubt that deep tariff increases might currently have an accurate pricing model. Market participants expect information from major US economic reports this week about the Q4 GDP growth rate and the PCE price index on Thursday and Friday respectively.

The recent economic figures revealed diminishing strength that prompted markets to predict two Federal Reserve interest rate reductions this year.

Spain Inflation Rate Up to 8-Month High of 3%, as forecast

Statistics indicate that Spain’s annual inflation reached 3% during February 2025 which turned out to be the highest since June 2024 and marked the fifth month of continuous price gain. The reported figures matched predictions that analysts had made about the market.

Electricity pricing increases became the main reason for elevated inflation after February 2024 when electric prices had fallen in the same period.

Insurance that allowed personal vehicle fuel and oil prices to increase gradually minimized general inflationary forces. In February the core rate without food and energy items registered at 2.1% which marked its lowest level since December 2021 while the January figure stood at 2.4%.

Agricultural Commodities Updates: Cheese Rises by 3.64%

The highest increasing commodities during this period include Cheese with a 3.64% increase Coffee with a 1.16% rise and Rapeseed with a 0.94% higher value. The commodities experiencing the largest price decreases during this period include Oat Palm Oil and Rice.

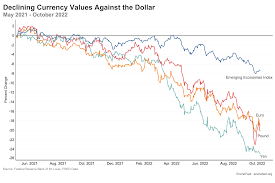

Euro Under Pressure Amid Tariff Threats

The euro showed declining value by reaching $1.048 before it dropped because economic analysts examined worsening trade tensions on European economic conditions. President Trump from the United States stated his intent to place taxes at 25% on European Union imports from automobiles to other products.

The European Commission confirmed a strong reaction will take place immediately against trade barriers that lack fairness and when countries use tariffs to dispute legitimate non-discriminatory policies. The political partnership between SPD and CDU/CSU is set to start formal discussions in Germany after their electoral victory.

Friedrich Merz as the incoming Chancellor indicated that Germany would not move forward rapidly with debt limit revisions. Markets wait for the ECB to announce its monetary policy decision next week. Market analysts predict the central bank will introduce a new quarter-point rate decline that will be followed by two successive rate cuts through September.

France Producer Inflation Slows to 0.7%

The French domestic market producer prices grew by 0.7% between January and February 2025 after recording a 0.9% increase during the previous month. The January softest monthly reading became possible because mining and energy prices fell (-0.1%) when compared with (+2.8% in December) six straight months of increases.

The drop in electricity rates (-1.0%) was matched by waste collection, treatment, and disposal services along with materials recovery services experiencing growth (+2.0%).

The price index for manufactured products showed stronger growth during this month than during the previous one (+1.1% vs +0.1%). French home market producer prices experienced their 14th monthly decrease in 2017 which resulted in a 2.1% drop for January after the December decline of 3.8%.